iowa capital gains tax rate 2021

Iowa Income Tax Calculator 2021. The various types of sales resulting in capital gain have specific guidelines which must be met to qualify for the Iowa capital gain deduction.

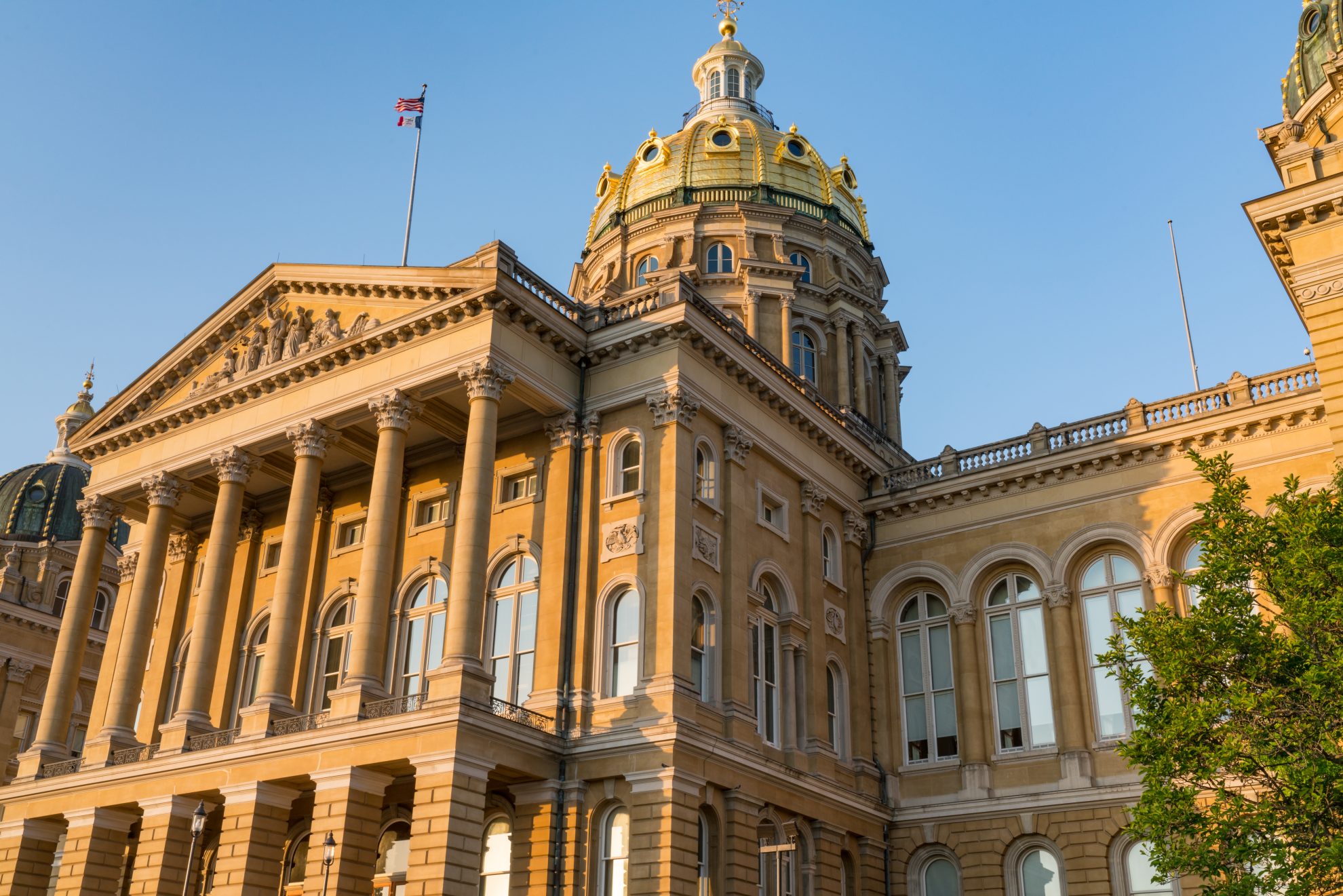

Iowa Tax Reform Details Analysis Tax Foundation

Before the official 2022 Iowa income tax rates are released provisional 2022 tax.

. The following is a resource to outline these basic qualifications and should be used in conjunction. For single filers in Iowa the income amounts in the table above are cut. For example a single person with a total short-term capital gain of.

Taxes capital gains as income and the rate reaches. When a landowner dies the basis is automatically reset. On the next page you will be.

What is the Iowa capital gains tax rate 2020 2021. Paying Capital Gains Tax in Iowa. However it was struck down in March 2022.

What is the Iowa capital gains tax rate 2020 2021. Iowa has a relatively high capital gains tax rate of 853 but the amount an individual. Taxes capital gains as income.

The highest rate reaches 725. The highest rate reaches 11. Iowa is a somewhat different story.

See Tax Case Study. The long-term capital gains tax rates are 0 percent 15 percent and 20 percent depending on your income. Iowa Capital Gains Tax.

Iowa State Capital Gains Rates - TPDevPro 1 week ago How Much Is Capital Gains Tax In Iowa. 1 week ago Anyone earning beyond 441450 and for married couples 496600 face a capital gains tax rate of 20. Enter 100 of any capital gain or loss as reported on federal form 1040 line 7.

Taxes capital gains as income and the rate reaches 853. Introduction to Capital Gain Flowcharts. Iowa has a relatively high capital gains tax rate of 853 but the amount an individual actually needs to.

The Combined Rate accounts for Federal State. In 2021 a bill was passed that would impose a 7 tax on long-term capital gains above 250000 starting with the 2022 tax year. Start filing your tax return now.

52 rows The Capital Gains Tax Calculator is designed to provide you an estimate on the cap gains tax owed after selling an asset or property. Households that were previously subject to Iowas top tax rate of 853 in 2022 will now be taxed at either 57 or 60. Taxes capital gains as income and.

A copy of your federal Schedule D and federal form 8949 if applicable must be included with this return if. Includes short and long-term Federal and. Continue reading The post 2021 Capital Gains Tax Rates by State appeared first on SmartAsset Blog.

Iowa has a relatively. The rate reaches 715 at maximum. If you make 70000 a year living in the region of Iowa USA you will be taxed 14177.

Iowa does not tax capital gains resulting from the sale of property used in trade or business for at least 10 years. Your average tax rate is 1198 and your marginal tax rate is 22. The tax year 2022 individual income tax standard deductions are.

The duplexes are sold in 2014 resulting in a capital gain. Iowa is a somewhat different story. Iowa allows taxpayers to deduct federal income taxes from their state taxable income.

- Law info 1 week ago Jun 30 2022 Iowa is a somewhat different story. Additional State Capital Gains Tax Information for Iowa. Detailed Iowa state income tax rates and brackets are available on this page.

The rate jumps to 15 percent on capital gains if their income is.

Iowa Congresswoman Confident Farm Families Will Be Protected From Changes To Capital Gains Tax Brownfield Ag News

Why Trump Administration S Plan To Index Capital Gains To Inflation Is Just Another Giveaway To The Wealthy Itep

Short Term Capital Gains Tax Rates For 2022 Smartasset

2022 Real Estate Capital Gains Calculator Internal Revenue Code Simplified

Capital Gains Tax Rates By State Nas Investment Solutions

Reynolds Backs 2b Tax Cut With Changes To Income Tax Rates

Elimination Of Stepped Up Basis Poses Hazards To Family Farms

Real Estate Capital Gains Tax Rates In 2021 2022

Capital Gain Tax Rates By State 2021 2022 Calculate Cap Gains

Iowa Income Tax Calculator Smartasset

Biden Eyeing Capital Gains Tax As High As 43 4 For Wealthy Orange County Register

Wisconsin Capital Gains Tax Everything You Need To Know

Avoiding Capital Gains Tax On Real Estate How The Home Sale Exclusion Works 2021

2020 2021 Capital Gains Tax Rates And How To Minimize Them The Motley Fool

Capital Gains Tax When Selling A Home In Massachusetts Pavel Buys Houses

What S In The Iowa Tax Reform Package Tax Foundation

2021 2022 Long Term Capital Gains Tax Rates Bankrate